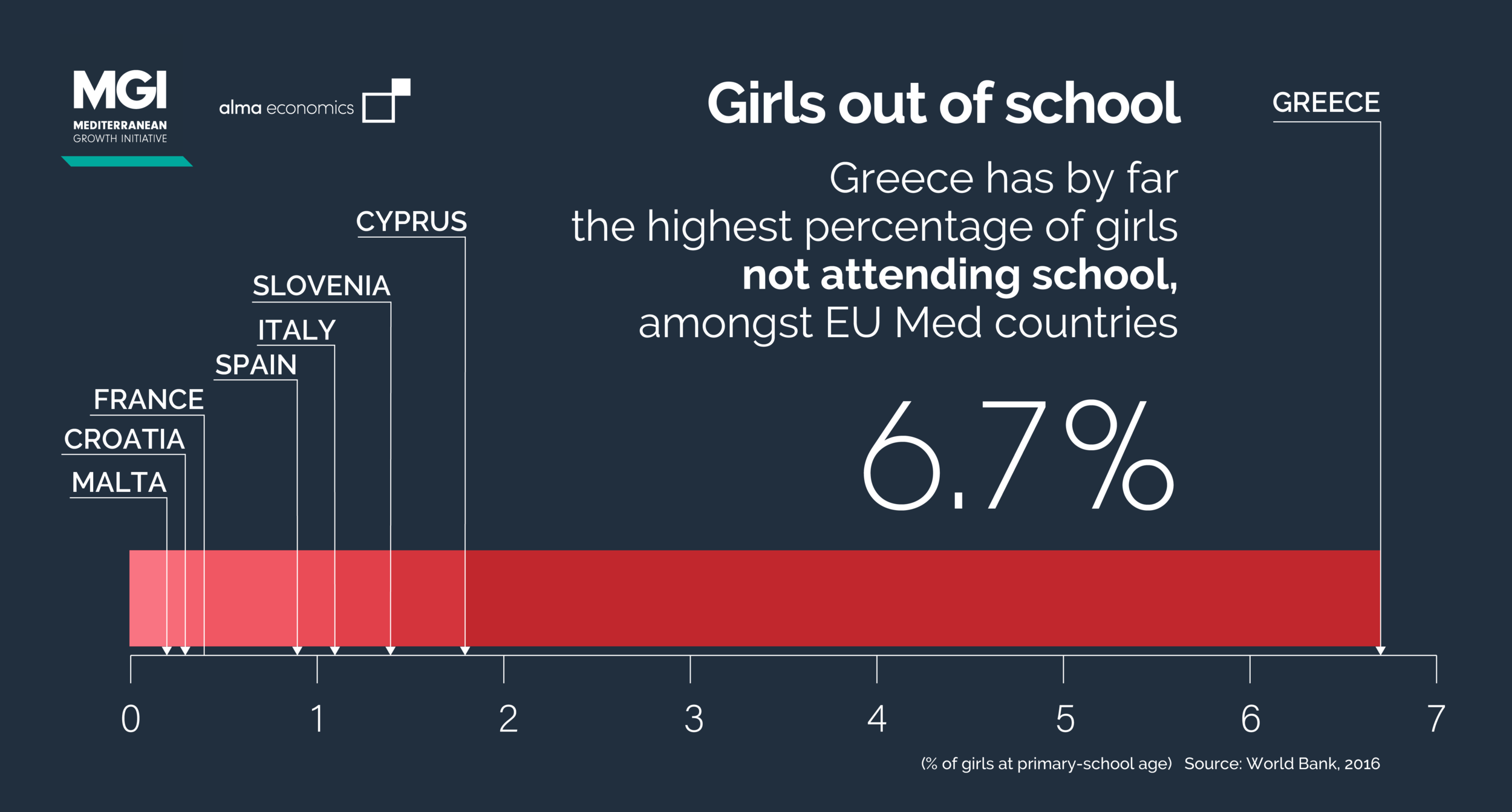

Girls out of school in Southern EU countries. Unbelievable but true!

As southern EU country leaders are about to meet in Cyprus this coming Monday January 29, 2019, they should better discuss why we still have girls out of school. Greece has the highest percentage of girls out of school, followed by Cyprus.

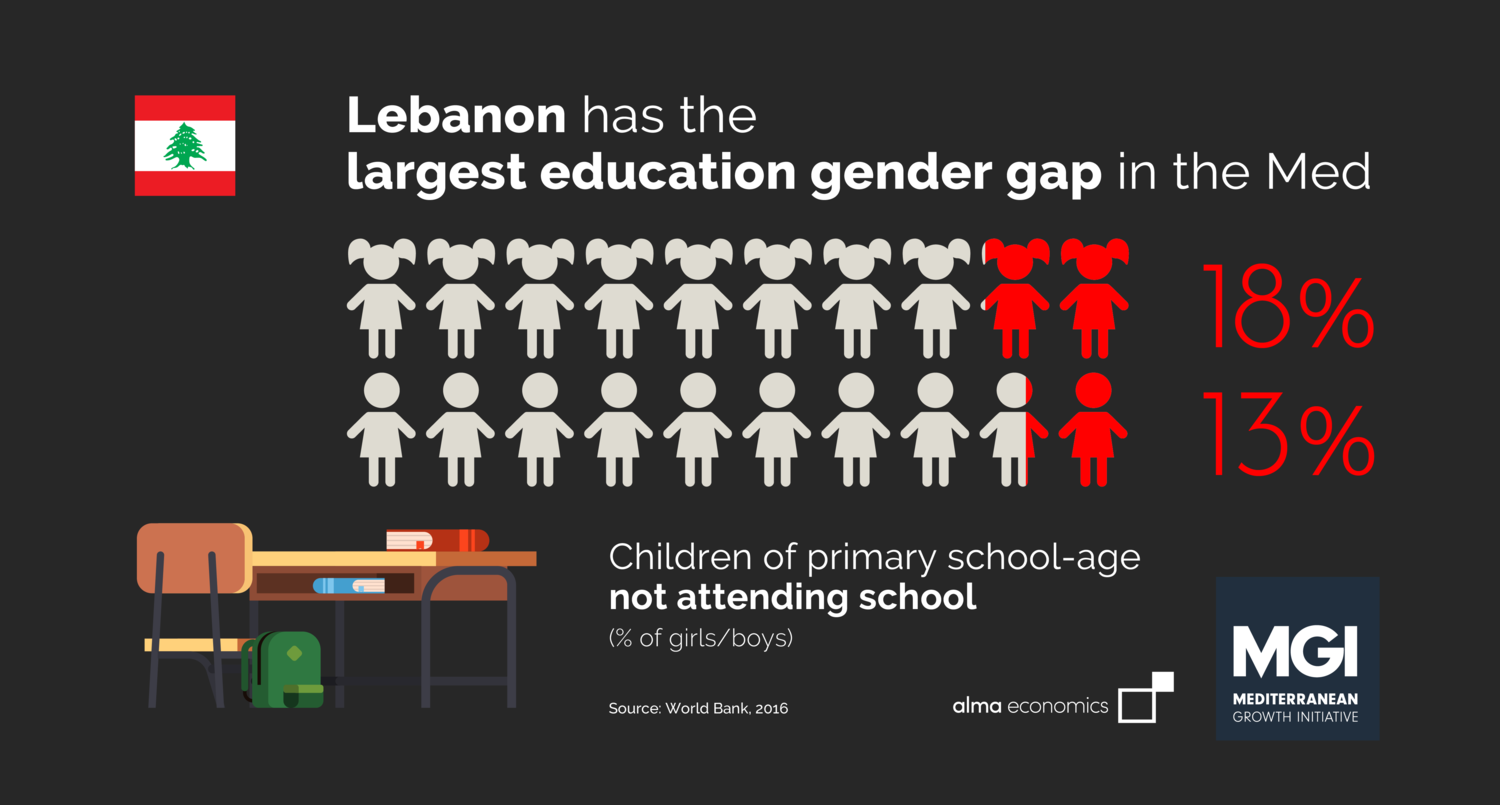

On Lebanon's education gender gap: Data analysis highlights the gap that crawls into the dynamics...

Lebanon, like many countries in the Med, have in-built resilience in their cultural DNA. Lebanon is also an entrepreneurial nation with a large active and enlightened diaspora. With the war in Syria, Lebanon has been incurring significant inflows of refugees hosted over the last 8 years in its cities and rural communities. Recent data analysis show Lebanon’s almost flat economic growth rate and a creeping unemployment rate. Women and girls are a most important socio-economic component to ensure growth, stability and peace.

Participation of women and girls in the workforce and in education is a key pillar...

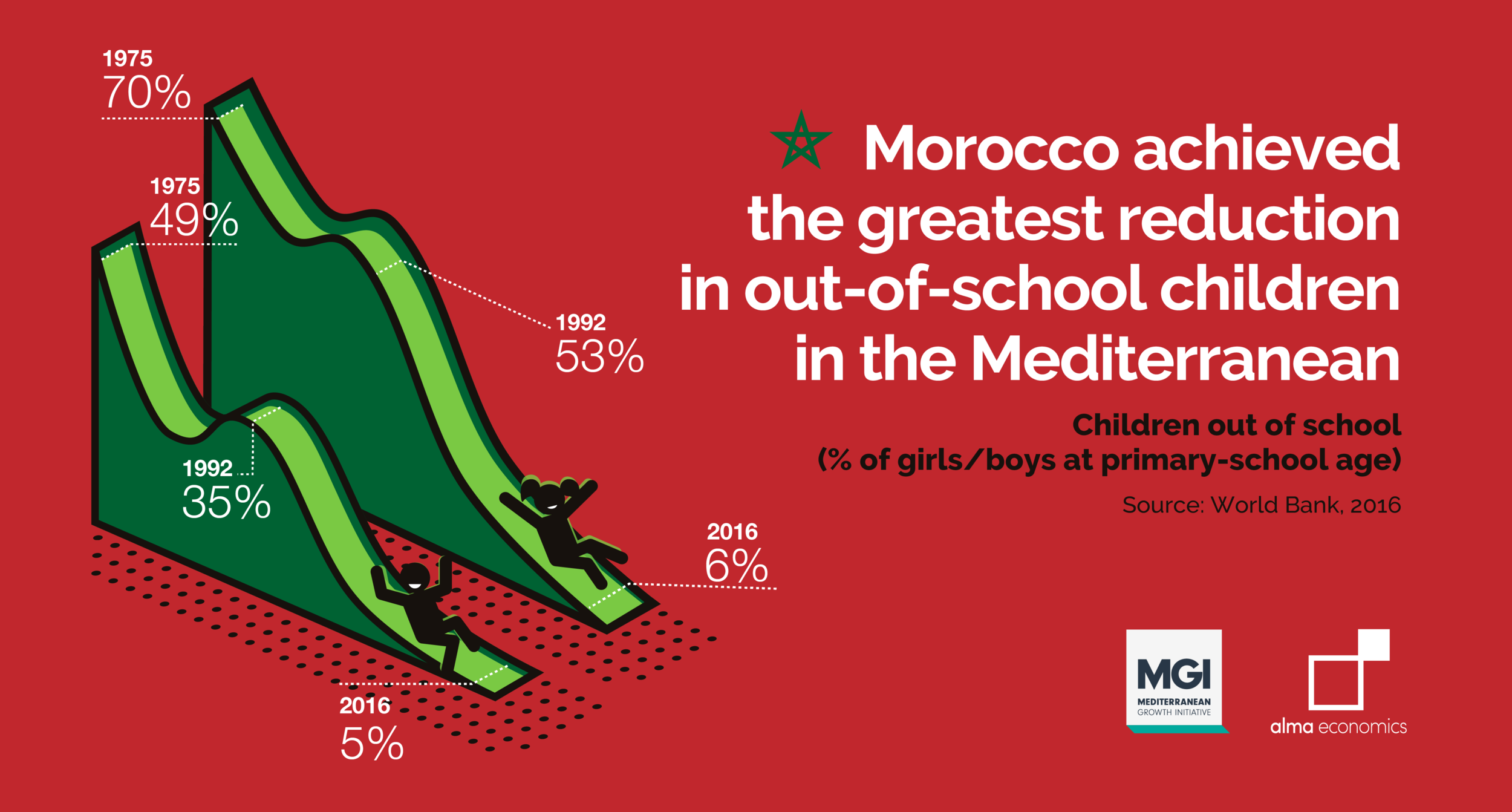

It has been more than 5 years since I founded the Mediterranean Growth Initiative, boldly advocating the merits of the Mediterranena as an economic space in global trade and delivering real-time date analysis to support policy thinking and doing in the region. At the start ofthis year, we are launching new work, focusing on a series of infographics and data driven analysis on education and gender across the Mediterranean region - starting with Morocco.

We ended 2018 – our third year running – with a bang: The Mediterranean Growth Initiative (MGI) has signed a collaboration agreement...

Our collaboration agreement with the CMI is testament to shared vision, validated methodology and sense of purpose. It speaks to the need for informed policy making, but equally important the need for governments and multilateral institutions to benchmark impact of policy on citizenry, having the tools to improve and align policy with real time information. Read more in my 2019 MGI.online founder's message above.

Wishing you all a very happy new year,

Cleopatra

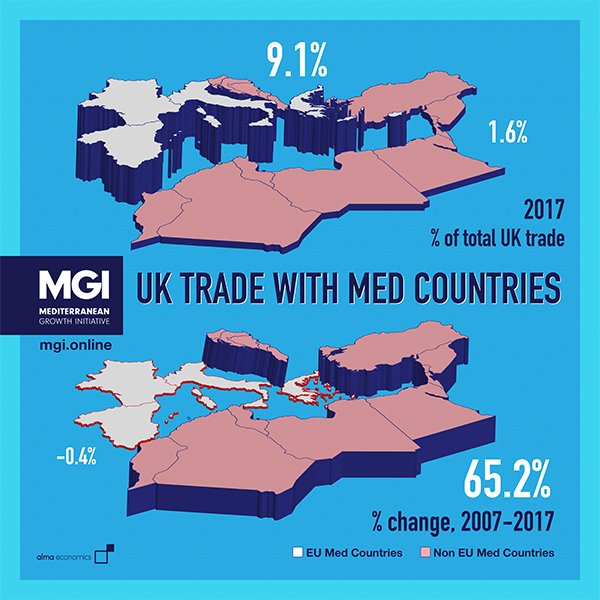

As the UK debates its role in Europe and the world, trade synergies with North Africa...

Energy at the core of UK and North Africa trade. As part of our Brexit series, the UK is to take note of its dependence on North Africa and the Med as important energy sources.

Fact based evidence shows how the ties that bind Mediterranean to the UK are stronger...

Ties and Trade Flows. Brexit and the Med. Another fact based snapshot of our mgi.online Brexit series: Cyprus and Israel at the heart of imports from the UK.

Anticipate and manage for geopolitical, trade, corporate governance codes and regulators changes

This blogpost is shared as part of a series of insights from INSEAD Directors Network, based on roundtable discussions held during INSEAD Directors Forum October 2018. The Directors Forum Round Table Discussions were held with IDN members led by IDN board members or IDN Ambassadors.

The roundtable discussion was led by Cleopatra Kitti, IDN Ambassador Cyprus.

It is with great joy that I am able to share with you, as founder of The Mediterranean Growth Initiative,...

The Mediterranean Growth Initiative and the Center for Mediterranean Integration announce their partnership - fostering cooperation amongst the countries of the Mediterranean.

Israel’s extrovert trade strategy does not just record highs transatlantically, it hits a record...

From all the Med countries, Israel tops exports to the UK.

Britain exports EUR 2.6 billion worth of jewellery and semi precious stones to non EU Med countries...

Precious trade fact on Britain and the Med.

UK reliance on oil imports from the Med has increased significantly. Libya and Algeria…

How dependent is Britain’s energy supply on the Med?

Brexit: A View from the Med

Learning from mistakes in the Mediterranean – Brexit is more about British values than exit from Europe. Britain must find its voice and its “power offer” to its people and to the world.

In the last 10 years, UK trade with non-EU Med countries has grown by 65% whilst...

The Mediterranean represents 10% of global GDP and is home to 500 million people. As a proud Mediterranean, my page will be bringing facts, information and views from the region, so that we are better understood for our potential by international investors, policy makers, analysts. This page will be hosting a series of infographics, by MGI.online, the only real time data analysis, benchmarking and forecasting platform on the Mediterranean region. The first series focuses on the Med and Brexit.

Private Capital in Southern Europe: Italy

Italy has endured a torrid decade, suffering three recessions since 2008, with high levels of public debt, unemployment at above 10 per cent and a banking system lumbered with bad loans. Its political leadership has also drifted towards populism, with talk of a referendum to withdraw from the Euro currency, and a toughening anti-immigration stance.

Hard economic times tend to lead to a hardening of borders, with a zero-sum ‘us-and-them’ mentality. To counter the trend and support greater mobility of capital and people in the Mediterranean, a vibrant private sector is crucial for Italy’s future.

Private Capital in Southern Europe: France

Following the election of Emmanuel Macron last year, France has emerged as one of Europe’s more vibrant economies. In particular, it is building its tech sector in advanced areas such as artificial intelligence and attracting increasing investment from tech leaders, including IBM and Microsoft. Macron has been a welcome voice of internationalism, attempting to preserve the nuclear deal with Iran, for instance, and imploring European countries not to turn their backs on migrants. His recent promise to grant citizenship to a Malian illegal immigrant who saved a child dangling precariously from a balcony – taking the time to meet the man in person – was a welcome gesture at a time when other Western nations are moving in the ideologically opposite direction. Given that France faces its own emerging nationalist and far-right political movement, these achievements should not be taken lightly.

Private Capital in Southern Europe: Spain

Over the 30 years of my professional life in the EMEA region, the EU’s Southern Mediterranean markets have played an important role. I have led and managed projects executed on a pan-EU basis, yet each market has its own distinct culture. Every time I work on these projects, I am struck by how unique and unrelated the business cultures are in Spain, in Italy, in France and in Greece. Aside from certain areas where the EU has imposed general guidelines, each market has its own regulatory, economic and cultural approaches. Implementing an investment decision or entering a new product market thus requires distinct market-specific benchmarks of success. The stereotypical perception is that most businesses in these countries are predominantly family-owned, SMEs or start-ups and that they are symmetric in business culture, meaning business is done in similar ways. In fact, this is not the case; there is actually much diversity, and to be successful requires cultural nuance. Equally striking is the very little cross-border activity between these countries.

To shed light on their diversity and interactions, the next three country profiles will examine Spain, France and Italy in terms of their inter-regional and cross-border potential.

Israel Turns 70: Where Next for the ‘Start-Up Nation’?

In preparing for this month’s blog – on Israel – I have asked Chemi Peres, a highly respected Israeli leader and entrepreneur, who co-founded Pitango Venture Capital, to give me his view and the thread for the analysis that follows. I was introduced to Chemi by Ambassador Yael Ravia-Zadok, when she was serving her country in Cyprus, building bridges of trust and collaboration between our two countries.

Chemi and I share a legacy left by our fathers. Shimon Peres, Chemi’s father – Nobel Peace Prize laureate, President of Israel, a statesman and an innovator – championed peace and collaboration. In Chemi’s words, his father was defined by the ‘ingenuity of a visionary driven by optimism and inspired by hope’.

My late father, Constantinos Kittis, also served his country and his people, with an honourable commitment to the wider good in both the public and private sectors. He was Minister of Commerce and Industry, Minister of Finance, founder of the European Movement in Cyprus, a regional leader of multinational businesses, a visionary, optimist, innovator and champion of good governance – but more importantly, he was a rare honest man with a high level of emotional intelligence.

Morocco: Time To Think Local?

Morocco is a beautiful country: seen in its colours, handicrafts, cuisine, architecture, aesthetics and people. I have visited many times in different capacities – for work and for leisure – and each time it leaves a magical impression. Travelling around the country, the disparity is clear – rural and urban, inland and seaboard – but at every turn, there is a keen work ethic and entrepreneurial spirit. Women have a key role to play, both within the family and as a productive force. But more can be done overall to promote a more equitable distribution of wealth, wider participation in the economy and better governance through business and policy leadership. This would allow the people and the country to continue to serve as a bridge between three continents – North America, Europe and Africa. The data-driven analysis that follows looks at how Morocco’s leadership pursues trade with Africa and Europe and, more importantly, the potential that lies closer to home, among its near neighbours in the Mediterranean.

Bringing Algeria’s Women into the Workforce

Algeria deserves to be integrated into the Mediterranean region. While I have not visited the country, I have been to its borders and have met Algerians abroad in different strata of life who have impressed me with their desire to improve economic conditions in their country – because they want to have a future within their country. This analysis focuses on women’s participation in the economy, and includes qualitative and quantitative data and indicators on trends. Women’s economic participation mirrors the progress or setbacks in the socioeconomic dynamics of the nation and the ability of its leaders to grapple with market forces and developmental challenges. It would be a good sign for Algeria if the European Bank for Reconstruction and Development (EBRD) launches operations there; in this way, Algeria’s private sector could be integrated into the markets of the region and standards of governance could be improved, including enhancing women’s role in business. Equally important for women’s participation in the economy, and for governance practices more broadly, is the European Investment Bank’s (EIB) 2.1 billion-euro investment on projects in the transport, energy, water and industry sectors. But it will take bolder steps in domestic and EU-backed policy to help women claim their rightful place in the country’s economic future.

Start-Ups: The Growth Egypt Needs

Egypt is the Mediterranean region’s largest economy, connecting the Arab world to Europe through my native country Cyprus, which forms the continent’s south-eastern border. My ties to Egypt are quite personal, as I bear the name of Cleopatra, the Egyptian queen of the Ptolemaic dynasty, which ruled Egypt until the Roman period. Curious about the history of this richly diverse country, I travelled through Egypt in my youth, exploring the Sinai mountain region while on a religious pilgrimage to St Catherine’s monastery. I also worked as a conflict resolution volunteer in rural areas in the northern and eastern regions.

At the last European Bank for Reconstruction and Development (EBRD) annual meeting and business forum, where I represented the Arab International Women’s Forum, Egypt was seen to offer compelling opportunities, with reforms across sectors, an eagerness to attract investors in manufacturing, food production, processing and distribution, and energy – specifically renewables. The conversation missed a key dynamic for growth, however: youth, specifically young people as Egypt’s start-up entrepreneurs, including the tools they need to prosper, especially their access to finance.